Receivables

Receivables: Frequently, customers will owe money to a business. For example, when a business provides a service or sells goods, customers may not pay for them right away. In this case, the business is giving credit to its customers. In other words, the business will create an account for the customers and expect to collect payment within a relatively short period, such as 30 or 60 days. To the business, these accounts are called accounts receivable (AR).

These accounts are trade-related, i.e. they are the result of the main activities of a business. For example, a house painting business would have accounts receivable arising from painting services not paid for. A hardware store would have them arising from the sale of hardware equipment from suppliers not paid for.

Other receivables, however, are not trade-related. They are, for example, loans given business employees, tax monies due from the Inland Revenue (due to tax overpayment), interest receivable on funds deposited with the bank.

Regardless of how careful a company is in granting credit, some debts will be uncollectible and will need to be written off (considered as worthless) – or treated as an expense. Such an expense is called bad debt expense.

We can expect that an account may be uncollectible when:

* It is past due.

* The customer does not respond to the company’s attempts to collect.

* The customer files for bankruptcy.

* The customer closes its business.

* The company cannot locate the customer.

There are 2 methods of accounting for uncollectible debts:

1. The direct write-off method - records bad debt expense only when an account is determined to be worthless.

2. The allowance method - records bad debt expense by estimating uncollectible accounts at the end of the accounting period.

Direct write-off method:

On May 10, a $4,200 account receivable from Ross has been determined to be uncollectible. Hence the account is written off. In other words, Ross' account disappears completely from the business’ records.

Dr Bad debt expense (Income Statement/IS) 4,200

Cr AR - Ross (Balance Sheet/BS) 4,200

However, later on, the account written off on May 10 is collected on November 21. Ross' account now has to be reinstated and the accounting entry above has to be completely reversed.

Dr AR -Ross (BS) 4,200

Cr Bad debt expense(IS) 4,200

Reinstatement entry.

Since cash was received,

Dr Cash 4,200

Cr Account receivable-Ross 4,200

The allowance method:

On December 31, ExTone Company estimates that a total of $30,000 of the $200,000 balance of their accounts receivable will eventually be uncollectible. Notice that this is an estimated total, and applies to an entire accounts balance – not to any specific account.

Dr Bad debt expense (IS) 30,000

Cr Provision for doubtful debts (BS) 30,000

Estimated provision for doubtful debts.

Note: The specific customer accounts cannot be decreased, so a contra account, Provision/Allowance for Doubtful Accounts, is credited. The net amount that is expected to be collected, $170,000 ($200,000 – $30,000), is called the net realizable value (NRV) of the receivables. The adjusting entry reduces receivables to the NRV and matches uncollectible expenses with revenues.

What if an account which has been provided/allowed for now needs to be written off?

On January 21, Parker’s account of $6,000 is written off because it is uncollectible. Since the failure to collect is confirmed, it is no longer part of an estimate. Therefore, it needs to be excluded from the provision for doubtful debts as well:

Dr Provision for doubtful debts (BS) 6,000

Cr AR -Parker (BS) 6,000

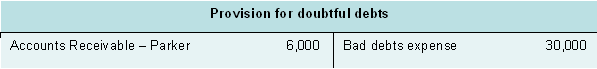

The provision for doubtful debts account will now look like this:

How do we write off additional uncollectible accounts?

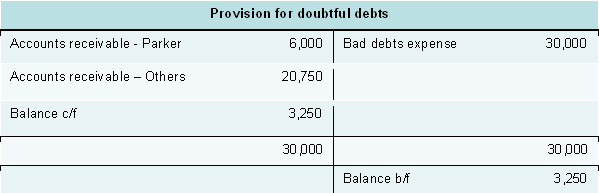

During 2012, ExTone Company writes off $26,750 of uncollectible accounts, including the $6,000 account of Parker. In other words, the additional amount to be written off is $20,750 ($30,000 - $6,000). This will leave a balance of $3,250 ($30,000 – $26,750) in the Provision for Doubtful Debts account:

An account has already been written off. But lo and behold, money was collected on it. What now?

However, after the write-off performed above, Nancy’s account of $5,000 was collected on June 10. The previous balance written off, that pertaining to Nancy’s account, now has to be reinstated.

The original entry (write-off) was:

Dr Provision for doubtful debts (BS) 5,000

Cr Account receivable-Nancy (BS) 5,000

…and it has to be reinstated as follows:

Dr Account receivable-Nancy (BS) 5,000

Cr Provision for doubtful debts (BS) 5,000

Reinstatement of entry.

The cash received from Nancy is taken up as follows:

Dr Cash (BS) 5,000

Cr Accounts receivable-Nancy (BS) 5,000

Cash received from Nancy.

Writing BACK provision for doubtful debts

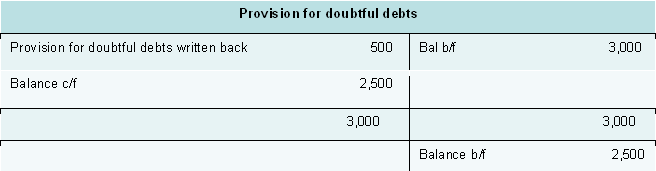

At the start of a year, a business has RM3,000 on its provision for doubtful debts account. By the end of the year, doubtful debts have decreased to RM2,500.

The entries are:

Dr Provision for doubtful debts 500

Cr Provision for doubtful debts written back 500

(Other income)

How do we estimate uncollectibles?

The allowance method requires an estimate of uncollectible accounts at the end of the period. Two methods are used to estimate the amount debited to Bad Debt Expense. 1. Percent of sales method 2. Aging method

Percentage of sales method:

If ExTone Company’s credit sales for the period are $3,000,000 and it is estimated that 1% will be uncollectible, Bad Debt Expense is debited for $30,000 ($3,000,000 x 0.01). This approach disregards the balance of $3,250 in the allowance account before the adjustment.

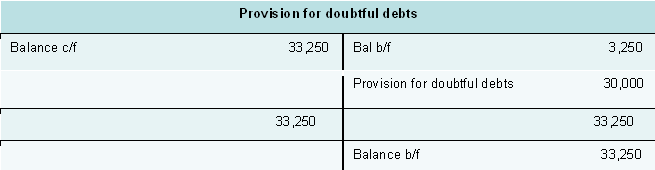

After the following adjusting entry on December 31 is posted, Provision for Doubtful Accounts will have a balance of $33,250 ($3,250 + $30,000).

The double entry is as follows:

Dr Bad debts expense 30,000

Cr Provision for doubtful debts 30,000

The Provision for Doubtful Debts will look like this:

Aging method:

The longer an account is outstanding, the less likely it is that it will be collected. Basing the estimate of uncollectible accounts on how long specific amounts have been outstanding is called the aging method.

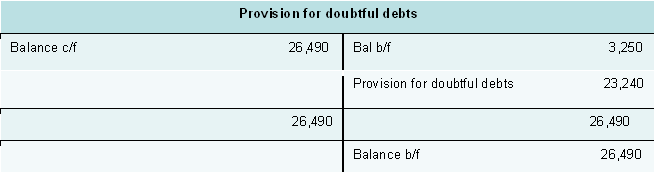

Let’s say that ExTone Company has an unadjusted credit balance of $3,250 in Provision for Doubtful Accounts. The estimated uncollectible accounts totaled $26,490. The amount to be added to the allowance account is $23,240 ($26,490 – $3,250). The adjusting entry is as follows:

Dr Bad debts expense 23,240

Cr Provision for doubtful debts 23,240

After the preceding adjusting entry is posted to the ledger, ExTone Company’s Provision for Doubtful Accounts will have an adjusted balance of $26,490. This is the amount that was determined by aging the accounts.

The Provision for Doubtful Debts will look like this:

Return to Accounting Terms from Receivables.