Pricing Decisions

Pricing Decisions:

As you run your own business, you will need to make decisions on how to price your products or the services that you are selling. How do you set a “correct” price?

In this section, we will look at some common pricing approaches – in particular, we will look at one approach for the short term, as well as one for the long term.

What influences prices?

But first, let us look at what influences prices. Firstly, customers affect the prices that you would set, through their effect on demand. If there is a healthy demand for a product or a service, then you could charge a higher price – because for a person who wants the product/service but can’t afford it, there is someone else who want it AND can afford it, and will buy it. On the other hand, if demand is poor, then prices would have to be set lower – to tempt customers to buy.

Secondly, competitors influence prices through their actions. Are you operating in a monopoly – in other words, does your product/service dominate the market it is in? If so, then you are free to set prices as you wish because there are no other alternatives for your customers. If there are alternative or substitute products offered by competitors, this may affect demand and force a business to lower prices.

Thirdly, costs influence prices because they affect supply. The lower the cost relative to the price, the greater the quantity of product the company is willing to supply.

Pricing decisions: for the short term

Most pricing decisions are either short term or long term.

Short-run decisions typically have a time horizon of less than a year.

An example of a short-run pricing scenario is setting the price for a one-time-only special order. This is when a business is already manufacturing products for sale in the market. It then gets an offer from a third party to manufacture a special order (one-off), on top of what it is already manufacturing.

Let’s look at an example of pricing for a special order:

The Caddy Corporation operates a plant with a monthly capacity of 500,000 cases of tomato sauce. Caddy is presently producing 300,000 cases per month.

Supermarket Ltd has asked Caddy and 2 other companies to bid on supplying 150,000 cases each month for the next 4 months.

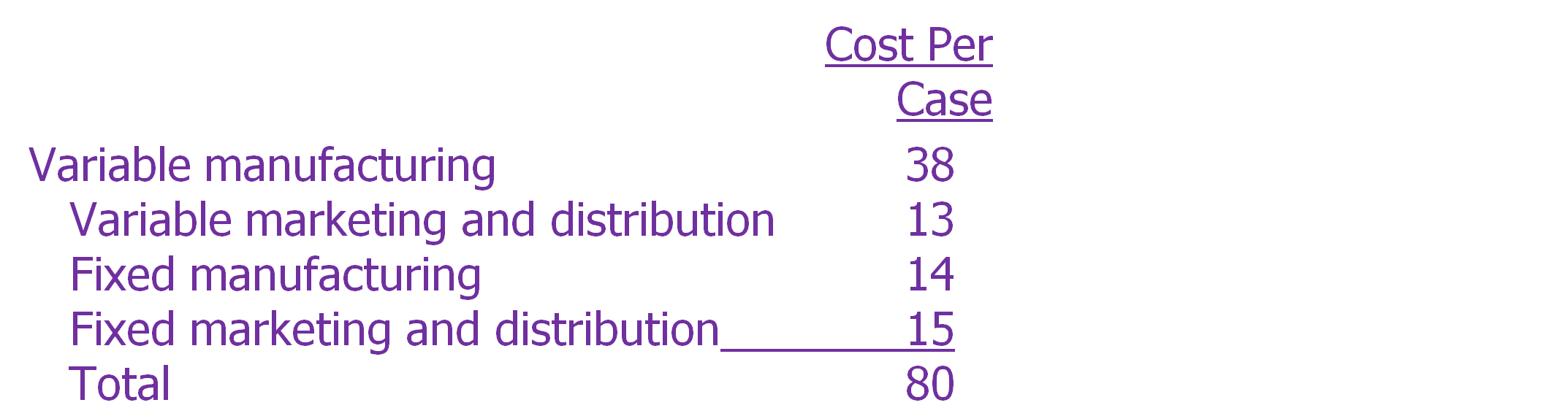

The current manufacturing costs are as follows:

If Caddy makes the extra 150,000 cases, the existing total fixed manufacturing overhead ($4,200,000 per month) would continue, plus an additional $165,000 of fixed overhead will be incurred per month.

Total fixed marketing and distribution costs will not change.

What price should Caddy bid?

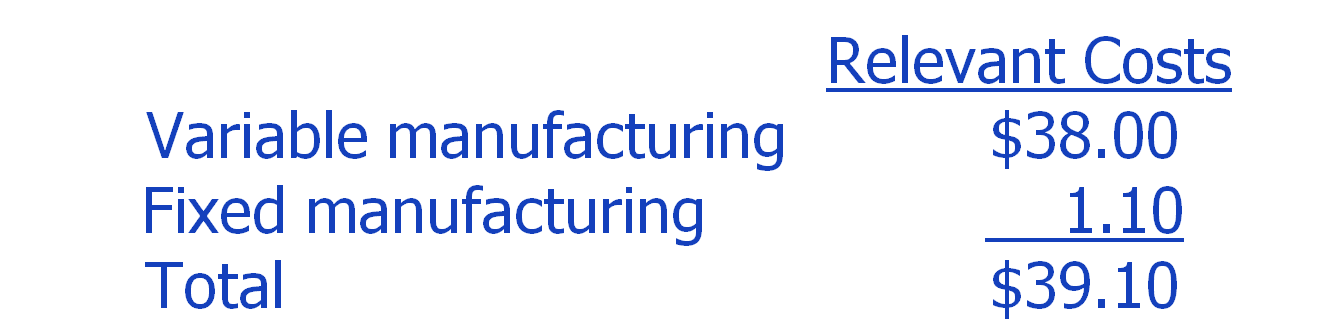

Our focus should be on the additional costs that will be incurred, which are as follows:

Note:

* Fixed manufacturing costs are calculated as: $165,000 ÷ 150,000 units = $1.10

** Variable marketing and distribution costs do not increase, because there is no need to perform marketing and distribution activities, since the customer was a walk-in and therefore, is a ‘sure thing’.

Any bid above $39.10 will improve Caddy’s profitability in the short run.

However, suppose that Caddy believes that Supermarket will sell the tomato sauce in Caddy’s current markets, but at a lower price than Caddy. This will mean that Supermarket’s product would be more price-competitive compared to Caddy’s product – hence, Caddy should increase the bid price accordingly to take this into account.

Pricing decisions: for the long term

Long-run decisions involve a time horizon of a year or longer. An example of pricing for the long-term is that for a product in a major market where price setting has considerable leeway (can be reduced and then increased slowly over a period of time).

Let’s look at an example:

Alpha Computer Corporation manufactures two models of computers: Easy and Complex.

Alpha uses a long-run time horizon to price Complex.

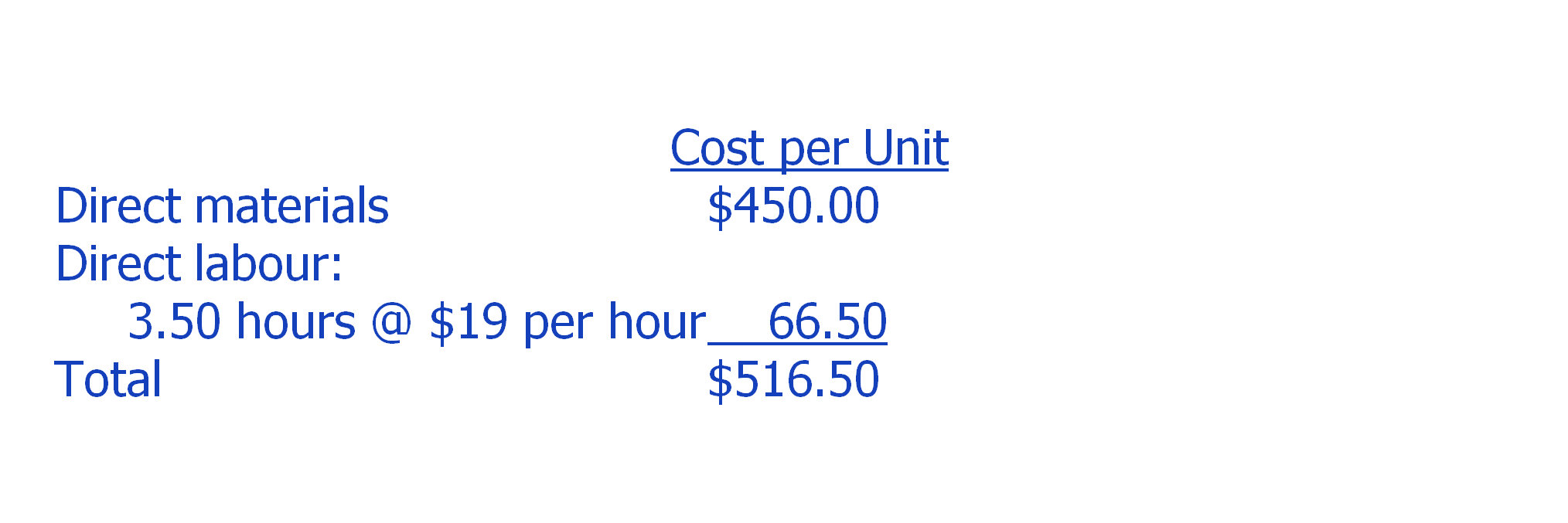

Direct materials costs vary with the number of units produced.

Direct manufacturing labour costs vary with direct manufacturing labour hours.

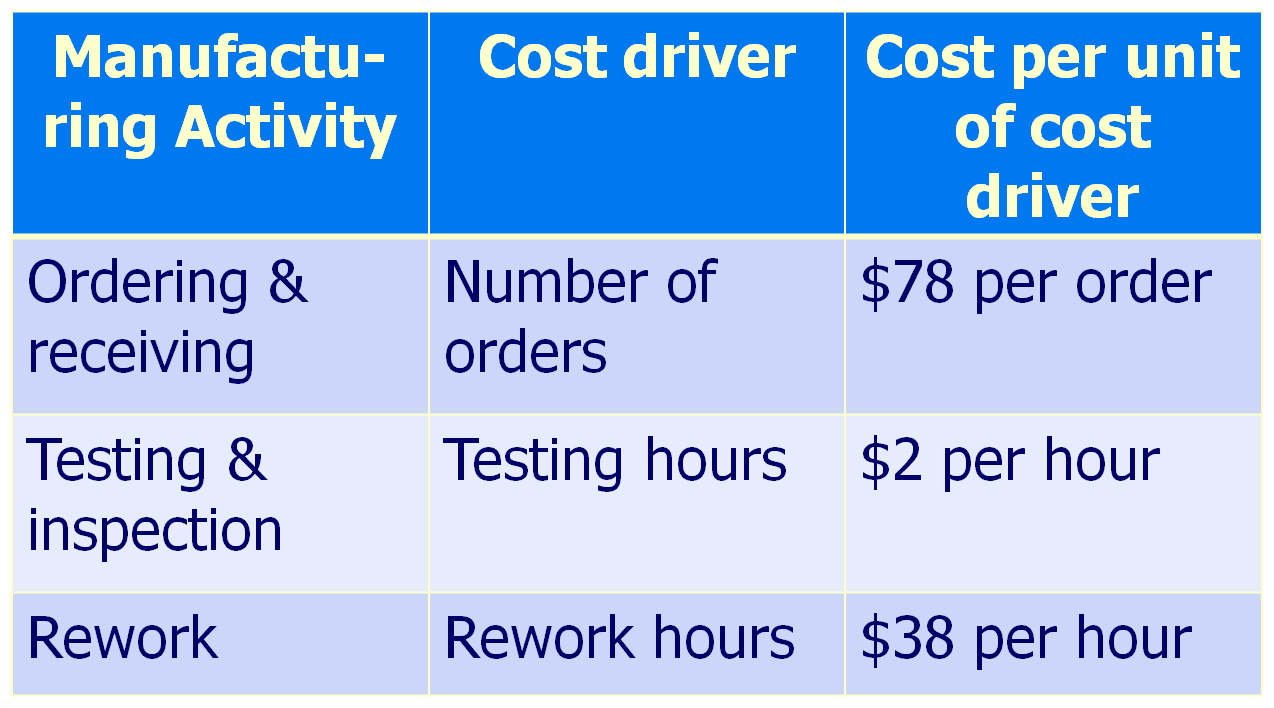

Ordering and receiving, testing and inspection, and rework costs vary with their chosen cost drivers.

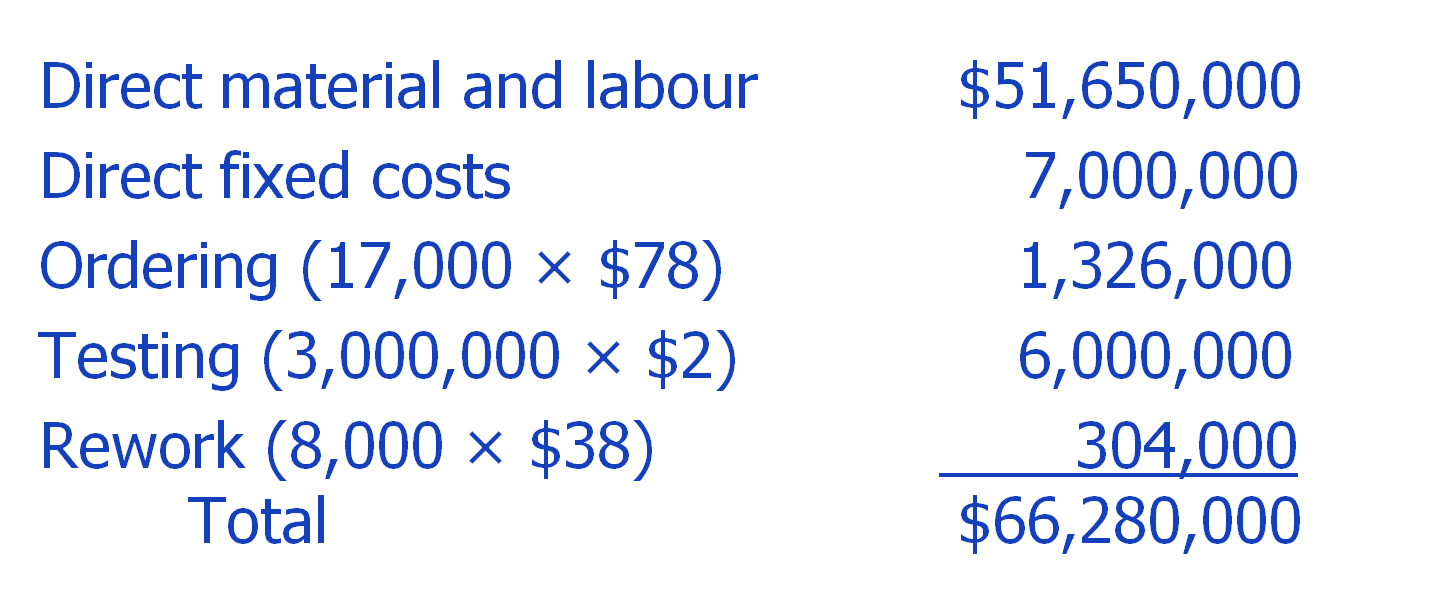

Alpha uses the following information to calculate the cost of manufacturing 100,000 units of Complex:

Number of orders placed: 17,000

Number of testing hours: 3,000,000

Number of units reworked: 8,000

The direct fixed costs of machines used exclusively for the manufacture of Complex total $7,000,000.

What is the cost of producing 100,000 units of Complex?

Hence, cost per unit would be: $66,280,000 ÷ 100,000 units = $662.80/unit

The price for each unit would need to be above $662.80.

To look at other long-run approaches to pricing, click here and here.

Return to Introduction to Management Accounting from Pricing Decisions.