The double entry method

The accounting double entry system builds on what we have learned in the accounting equation. Remember, it is expressed as:

Assets = Liabilities + Owner’s Equity

Earlier, we learnt that every business transaction has an equalizing effect on the accounting equation. In other words, an increase or decrease in any component of the equation will be ‘compensated’ by the increase/decrease of another component, so that the overall equation remains balanced. For instance, if assets increase by $5000 and liabilities increase by the same amount.

Refresh your memory about the Accounting Equation here.

We’re now going to build on that concept, and learn how to formalise it into accounting double entries.

The guideline is this: every component that experiences an increase/decrease in the accounting equation becomes a separate account, to record the transaction.

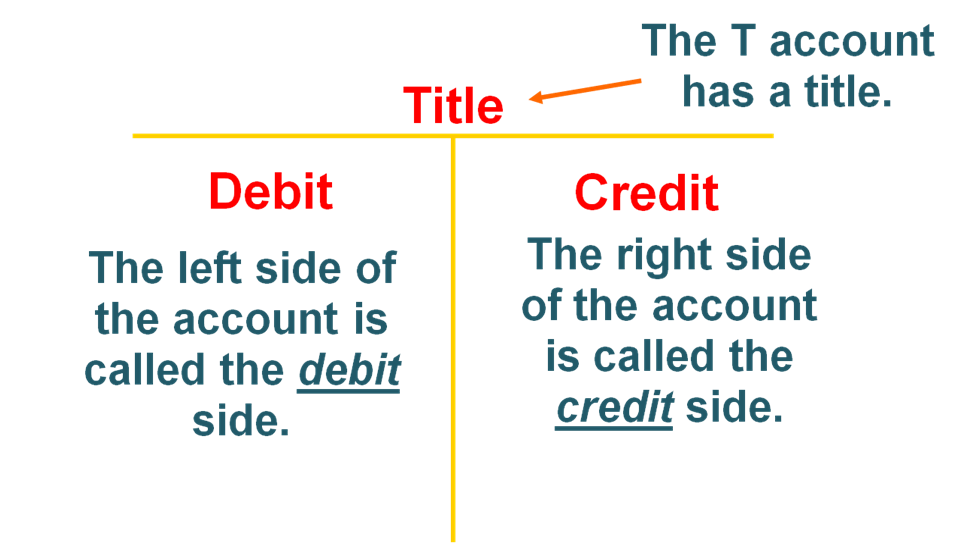

The traditional format of an account is a “T account”:

When recording transactions in account:

1. Every transaction must be recorded in at least 2 accounts.

2. The total debits recorded for each transaction must be equal to the total credits recorded.

But when does a transaction go to the debit side, and when does it go to the credit side?

Let’s go back to the accounting equation:

Assets = Liabilities + Owner’s Equity

Any increase to the left side of the equation will be a debit.

Any increase to the right side of the equation will be a credit.

Therefore, increase in assets will be debits.

Increase in liabilities will be credits.

Increase in owner’s equity will be credits.

Of course, the converse holds true, i.e.

Decrease in assets will be credits.

Decrease in liabilities will be debits.

Decrease in owner’s equity will be debits.

When we express a business transaction in terms of debits and credits, we are journalizing it, or writing it in a journal entry format.

For example:

The business owner (say, named Margaret) invested $10,000 cash into her business.

The effect on the accounting equation is:

Cash [Assets] is increased by $10,000.

Capital [Owner’s Equity] is increased by $10,000.

Therefore:

Assets = Liabilities

Up by $10,000 = Up by $10,000

In a journal entry, it is expressed as:

Debit Cash $10,000

Credit Capital $10,000

Usually the words ‘debit’ and ‘credit’ are shortened and the double entry becomes:

Dr Cash $10,000

Cr Capital $10,000

Let’s take the examples that we did from The Accounting Equation section, and see how the debit-credit rule applies.

1. The business paid $20,000 to buy a piece of land as a future building site.

The effect on the equation is:

Land [Assets] is increased by $20,000.

Cash [Assets] is decreased by $20,000.

Therefore:

Assets

Up by $20,000 AND

Down by $20,000

In a journal entry, it is expressed as:

Dr Land $20,000

Cr Cash $20,000

2. The business purchased supplies for $1,500 and agreed to pay the supplier one month from now.

The effect on the accounting equation is:

Assets - Up by $1,500

Liabilities - Up by $1,500

The journal entry is:

Dr Supplies $1,500

Cr Accounts payable $1,500

3. The business received cash of $8,000 for providing services to customers.

The effect is:

Cash [Assets] is increased by $8,000.

Revenue [Owner's Equity] is increased by $8,000.

The journal entry is:

Dr Cash $8,000

Cr Revenue $8,000

4. The business paid salaries to its workers using cash of $2,000.

The effect on the accounting equation is:

Cash [Assets] is decreased by $2,000.

Owner's Equity is increased by $2,000.

The double entry is:

Dr Salaries expense $2,000

Cr Cash $2,000

5. The business paid the amount owing to its accounts payable/creditor, of $5,200.

The effect on the accounting equation is:

Cash [Assets] is decreased by $5,200.

Accounts payable [Liabilities] is decreased by $5,200.

The journal entry is:

Dr Accounts payable $5,200

Cr Cash $5,200

The owner of the business withdrew $10,000 from the business for his own use.

The effect on the accounting equation is:

Cash [Assets] is decreased by $10,000.

Owner's Equity is decreased by $10,000.

The double entry is:

Dr Drawings $10,000

Cr Cash $10,000