Closing the accounts – using adjusting entries, or “What to do before we close the accounts for the year”

Adjusting entries...

At the end of the accounting period, usually right after the last day of the year, 31 December, businesses will close their accounts – tallying up the results for the year to see what the year’s performance was like. At this stage, all transactions/journal entries have been entered into the various accounts.

Before the accounts can be finally closed, they need to go through an adjusting process – in other words, they need to be updated. The journal entries that bring the accounts up to date at the end of the accounting period are called adjusting entries.

Four types of accounts will require adjustment: 1. Prepaid expenses 2. Unearned revenues 3. Accrued revenues 4. Accrued expenses

Prepaid expenses

Prepaid expenses are the advance payment of future expenses. For instance, rent is usually prepaid in advance before a business occupies a property. At the outset, the business has not yet “enjoyed” the occupation of the property, but has paid the rent for the said occupation. Therefore, there is a mismatch between rent payment and physical occupation/utilization of the space rented. In the accounting world, the advance rent paid cannot be initially recognized as an expense, but is instead recorded as an asset. However, at the end of the accounting period, a portion (if not all) of the prepaid rent may have been utilized. Under such circumstances, that portion would need to be charged out to expenses.

This can apply to prepaid supplies (which will be eventually used up), prepaid insurance (the coverage of which will be eventually utilized) and prepaid utilities, such as electricity and water.

Some worked examples:

ABC Enterprises’ supplies account has a balance of $2,000 on the unadjusted trial balance. Some of these supplies have been used during the period. On December 31, a count reveals that the amount of supplies on hand is $760.

Supplies (balance on trial balance) $2,000 Supplies on hand, December 31 – 760 Supplies used $1,240

The adjusting journal entry is:

Dr Supplies expense $1,240

Cr Prepaid supplies $1,240

Supplies used ($2,000 - $760).

To refresh your memory on Double Entries, click here.

The debit balance of $2,400 in ABC Enterprises’ prepaid insurance account represents the December 1 prepayment of insurance for 12 months.

Hence, for the year ended 31 December, 1 month’s worth of insurance has been utilized (1/12 X $2,400 = $200).

The adjusting journal entry is:

Dr Insurance expense $200

Cr Prepaid insurance $200

Insurance expired ($2,400/12).

Unearned revenues

Unearned revenues are the advance receipt of future revenues.

An example is when a business receives cash for services yet to be

provided, or for goods yet to be delivered. In other words, revenue has

yet to be earned, but payment has already been received – this creates a

mismatch. At the end of the accounting period (as with prepaid

expenses above), a portion or all of this revenue may have been earned,

which is then properly recognized as revenue. Another thing to note is that unearned revenues are part of liabilities, because until the revenue is actually EARNED, any cash received is considered payable back to the customer.

An example:

The credit balance of $360 in ABC Enterprises’ unearned rent account represents the receipt of three months’ rent on December 1 for December, January, and February.

At the end of December, one month’s rent has been earned.

The adjusting journal entry in the adjusting process is:

Dr Unearned rent $120

Cr Rent revenue $120

Rent earned ($360/3).

Accrued revenues

Accrued revenues are unrecorded revenues that have been earned, but cash has not yet been received.

Example:

ABC Enterprises signed an agreement with Emerson Company on December 15 to provide services at a rate of $20 per hour.

As of December 31, ABC had provided 25 hours of services. The revenue will be billed on January 15.

The adjusting entry is:

Dr Accounts receivable $500

Cr Fees earned $500

Accrued fees ($25 hours x $20 per hour).

Accrued expenses

And finally, accrued expenses refer to unrecorded expenses that have been incurred, but cash has not yet been paid. Notice that they are the opposite of accrued revenues.

ABC Enterprises pays its employees biweekly. During December, ABC paid wages of $950 on December 13 and $1,200 on December 27.

As of December 31, ABC owes $250 of wages to employees for Monday and Tuesday, December 30 and 31.

The adjusting journal entry in the adjusting process is:

Dr Wages expense $250

Cr Accrued wages $250

Accrued wages.

Usually accrued expenses are paid after the year end, in which case:

ABC Enterprises paid wages of $1,275 on January 10. This payment includes the $250 of accrued wages recorded on December 31.

The adjusting journal entry in the adjusting process is:

Dr Wages expense $1,025

Dr Accrued wages $ 250

Cr Cash $1,275

Payment of wages.

Depreciation

This is a particular category within accrued expenses that need special consideration. What is depreciation?

Fixed assets, or plant assets, are physical resources that are owned and used by a business and are permanent or have a long life.

As time passes, a fixed asset loses its ability to provide useful services. This decrease in usefulness is called depreciation.

All fixed assets, except land, lose their usefulness and, thus, are said to depreciate.

As a fixed asset depreciates, a portion of its cost should be recorded as an expense. This periodic expense is called depreciation expense, and is a usual adjusting entry at the accounting year end.

Example:

ABC Enterprises estimates the depreciation on its office equipment to be $50 for the month of December.

The adjusting entry is:

Dr Depreciation expense $50

Cr Accumulated depreciation $50

Depreciation on office equipment.

Notice that the fixed asset account is not decreased (credited) when making the related adjusting entry. This is because both the original cost of a fixed asset and the depreciation recorded since its purchase are reported on the balance sheet. Instead, an account entitled Accumulated Depreciation is increased (credited).

The difference between the original cost of the office equipment and the balance in the accumulated depreciation—office equipment account is called the net book value.

Adjusted trial balance

At the end of the adjustment process, the trial balance is updated with the adjusting entries accordingly. The adjusting entries are treated like any other journal entry before this – they are posted into the relevant accounts. The updated accounts will show final debit or credit balances, which are then extracted into the adjusted trial balance. This adjusted trial balance will be used to draft the financial statements – but that will be discussed in another section.

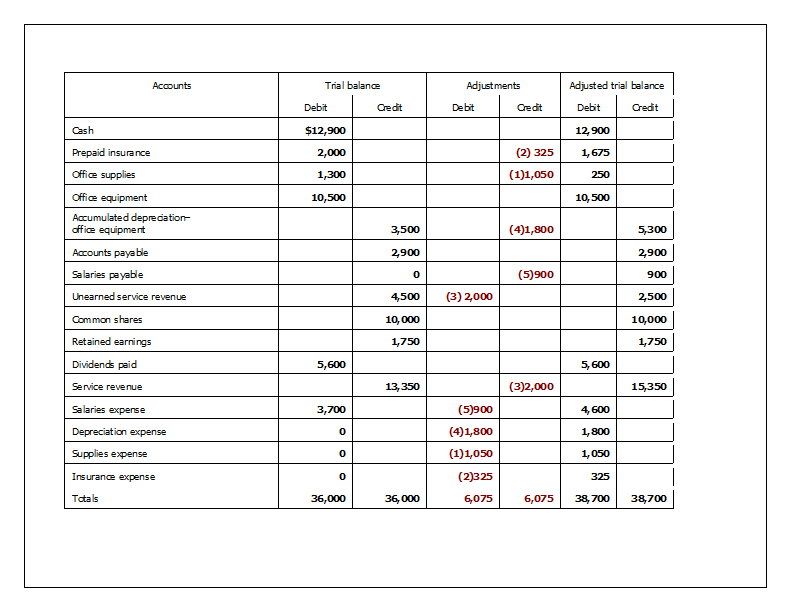

There is a neat trick to make sure that the adjusted trial balance “balances”. In other words, the total of the balances on the debit side must equal to the total of the balances on the credit side. The trick is to use an adjusting worksheet.

Let’s go through an example:

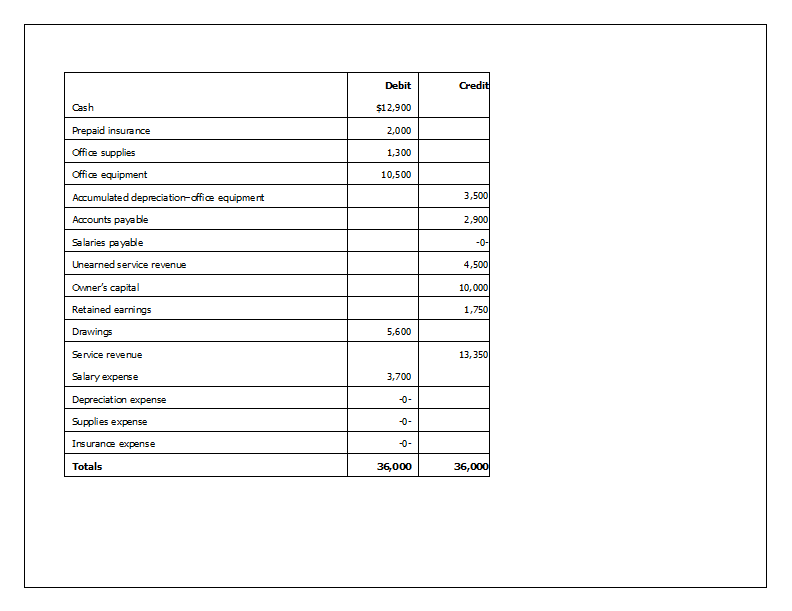

Verbatim Services Inc. has the following unadjusted balances at year-end.

The following information is available to use in making adjusting entries.

1. Office supplies on hand at year-end: $250

2. Prepaid insurance expired during the year: $325

3. Unearned revenue remaining at year-end $2,500

4. Depreciation expense for the year $1,800

5. Accrued salaries at year-end $900

To journalise the adjusting entries:

1. Office supplies on hand at year-end: $250

Office supplies per unadjusted trial balance: $1,300

Actual balance at year end: $250

Therefore, the balance needs to be adjusted by: $1,300 - $250 = $1,050.

Journal entry:

Dr Supplies Expense $1,050

Cr Office Supplies $1,050

2. Prepaid insurance expired during the year: $325

Journal entry:

Dr Insurance Expense $325

Cr Prepaid insurance $325

3. Unearned revenue remaining at year-end $2,500

Unearned service revenue per unadjusted TB: $4,500

Actual balance at year end: $2,500

Therefore, the balance needs to be adjusted by: $4,500 - $2,500 = $2,000.

Journal entry:

Dr Unearned service revenue $2,000

Cr Service revenue $2,000

4. Depreciation expense for the year $1,800

Journal entry:

Dr Depreciation Expense $1,800

Cr Accumulated depreciation $1,800

5. Accrued salaries at year-end $900

Journal entry:

Dr Salaries expense $900

Cr Salaries payable $900

The adjusting worksheet is as follows:

The debit/credit balances of the adjusted trial balance will be used to draft the final financial statements.

Want to read about what happens after the trial balance is adjusted? Go to Drafting Financial Statements.

Return to Accounting Adventurista Home from Adjusting Entries