All about Property Plant Equipment

Property plant equipment (also called “fixed assets”) form part of a business’ assets.

To recap, assets are:

1. owned AND

2. controlled in order to produce value.

For more about assets, go to Assets.

Property plant and equipment (thereafter referred to as “PPE”) are owned/held for the long term – more than a year. These are usually large items such as real property – buildings, factories, land developments – or vehicles, equipment and plant and machinery.

Depreciation

Over time, most property plant equipment lose their ability to provide services. Equipment or machinery could suffer wear and tear due to use, and buildings or motor vehicles could suffer from exposure to the weather. Or equipment or machinery could be of an older model, is now obsolete and cannot be used to its full capacity/potential.

To reflect this loss of ability to perform, an expense called depreciation is recorded.

Depreciation reduces the value of a property plant equipment over time.

Three factors determine the depreciation expense for a PPE:

1. The asset’s initial cost

2. The asset’s expected useful life

3. The asset’s estimated residual value

The expected useful life of a PPE, usually measured in years, is estimated at the time the asset is placed into service.

The residual value of a PPE at the end of its useful life, the value of the PPE after it has been fully depreciated, is also estimated at the time the asset is placed into service.

Accumulated depreciation is the total amount of depreciation charged up to a certain point in time.

Methods of depreciation

So how is depreciation calculated?

There are a few methods. We will discuss the most common 2 methods:

The straight-line method charges the same amount of depreciation expense for every year of the asset’s useful life. In other words:

Annual depreciation = (Initial cost – Residual Value)/Useful life

For example:

Initial cost $24,000

Expected useful life 5 years

Estimated residual value $2,000

Annual depreciation = (24,000 – 2,000)/5 years = $4,400 per year.

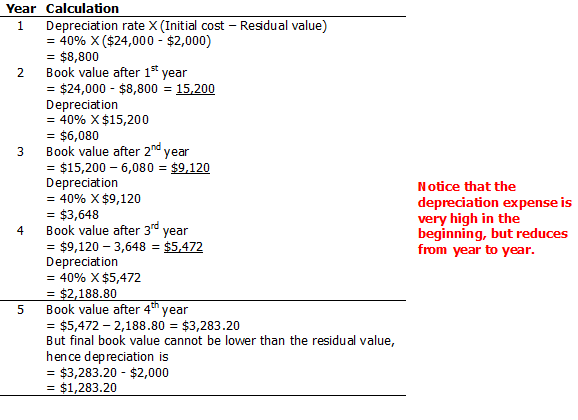

Another method is the reducing balance method, which charges depreciation every year by a fixed percentage on the remaining book value (cost minus accumulated depreciation).

For example:

Initial cost $24,000

Expected useful life 5 years

Depreciation rate 40%

Estimated residual value $2,000

Regardless of the method of depreciation, the accounting entry for depreciation is:

Dr Depreciation expense

Cr Accumulated depreciation

Revising depreciation estimates

Sometimes, depreciation estimates may change. The useful life may change – the property, plant and equipment may be used for longer than what was originally estimated. The residual value may change – the value may be more or less than initially estimated.

What happens when the changes occur during the useful life of the asset? Let’s see an example:

A machine is purchased on 1 January 2011, for $140,000.

Expected useful life 5 years

Estimated residual value $10,000

Annual depreciation, using the straight line method = (140,000 – 10,000)/5 years = $26,000

At the end of 2012, the asset’s book value is:

= Initial cost – accumulated depreciation

= $140,000 – ($26,000 X 2)

= $88,000

During 2013, the company estimates that the machine’s remaining useful life is 8 years (instead of 3 years) and that its residual value is $8,000 (instead of $10,000).

Book value at the end of 2nd year: $88,000

Revised residual value: $8,000

Revised depreciable cost = $88,000 – 8,000 = $80,000

Depreciation expense for each of the remaining 8 years is

= $80,000/8 years

= $10,000 per year

Addition/purchase of property, plant and equipment

When property plant equipment is purchased, the accounting entries are:

Dr Property plant equipment

Cr Cash/Payables

Write-off of Property Plant Equipment

Sometimes PPE may need to be discarded/thrown away when they are not used anymore. At this stage, we need to remove their existence from the accounting records.

For example:

Equipment acquired at a cost of $25,000 is fully depreciated at 31 December 2011.

On 14 February 2012, the equipment is discarded (thrown away).

The accounting records, as at 31 December 2011, would be as follows:

Property plant equipment – Equipment would show a debit balance of $25,000.

Accumulated depreciation – Equipment would show a credit balance of $25,000.

(In other words, book value as at 31 December 2011 is nil.)

Hence, to write off the equipment and remove it from the accounting records, we would need to put through the following journal entry:

Dr Accumulated depreciation – Equipment $25,000

Cr Property plant equipment - Equipment $25,000

Another example:

Equipment costing $6,000, with no residual value, is depreciated at an annual straight-line rate of 10%.

Annual depreciation = 6,000 X 10% = $600

After the 31 December 2011, Accumulated Depreciation—Equipment has a $4,750 balance.

On 24 March 2012, the asset is removed from service and discarded.

Note that the equipment has not been fully depreciated as at 31 December 2011.

Hence, we need to further depreciate it up to the date of the write-off, as follows: $600 X 3/12 = $150.

The accounting entry is:

Dr Depreciation expense 150

Cr Accumulated depreciation 150

The new accumulated depreciation balance as at 24 March 2012 is: $4,750 + $150 = $4,900.

Now, to write-off:

Dr Accumulated depreciation – Equipment 4,900

Dr Loss on write-off of equipment 1,100

Cr Property plant and equipment – Equipment 6,000

Note that the final difference between the cost of the equipment and accumulated depreciation is treated as an expense – a loss on equipment write-off.

Disposal/sale of PPE

Often, PPE is sold for cash proceeds. Let’s see an example:

Equipment was purchased at a cost of $10,000.

It had no estimated residual value and was depreciated at a straight-line rate of 10%.

The equipment is sold for cash of $1,000 on October 12 of the 8th year of its use.

The balance of the accumulated depreciation account as of the preceding December 31 is $7,000.

Annual depreciation = $10,000 X 10% = $1,000.

To further depreciate the equipment up to the date of disposal =

$1,000 X 9/12 = 750

The accounting entry is:

Dr Depreciation expense 750

Cr Accumulated depreciation 750

This brings the accumulated depreciation balance (12 October) to: $7,000 + $750 = $7,750.

To record the disposal:

Dr Cash 1,000

Dr Accumulated depreciation – Equipment 7,750

Dr Loss on disposal of equipment 1,250

Cr PPE – Equipment 10,000

Let’s say the cash proceeds from the sale are $3,000.

To record the disposal:

Dr Cash 3,000

Dr Accumulated depreciation – Equipment 7,750

Cr Gain on disposal of equipment 750

Cr PPE – Equipment 10,000

Notice that in the first case, the sales proceeds were less than the book value, while in the second case the sales proceeds exceeded the book value.

Return to Accounting Terms from Property Plant Equipment.