Make or buy decisions

Make or buy decisions

When you run a business, you often must decide whether to make a product or produce service within the business or purchase (outsource) it from a supplier. The choice you pick must make the most financial sense – in other words, it must maximize your profit.

Make or buy decisions: A worked example

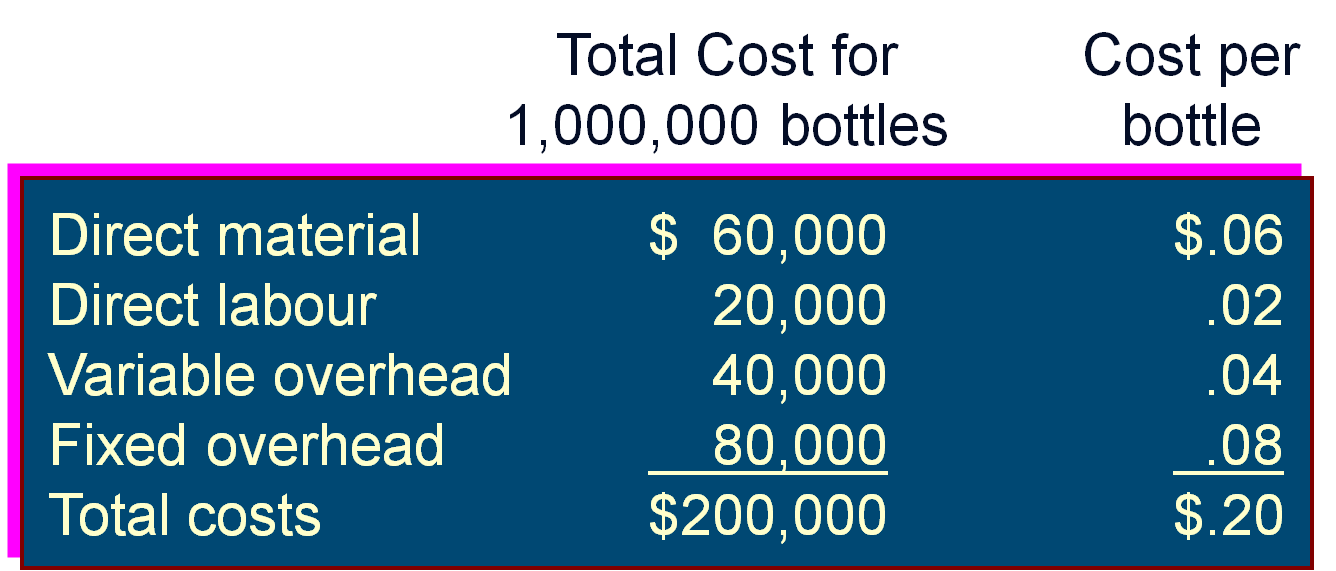

Fizzy Wonder Ltd is in the business of manufacturing bottled fruit-flavoured sodas. The costs of making the bottles to contain the drinks are as follows:

Let’s say that a supplier offers to sell Fizzy Wonder bottles at the cost of $0.18 per bottle. In other words, by doing this, Fizzy Wonder would not need to manufacture its own bottles.

You would assume that the answer is simple, right? If Fizzy buys from the supplier, the cost is $0.18 per bottle. The costs of making a bottle is $0.20. Easy choice it would seem.

However, this seldom is the case in a real-life situation.

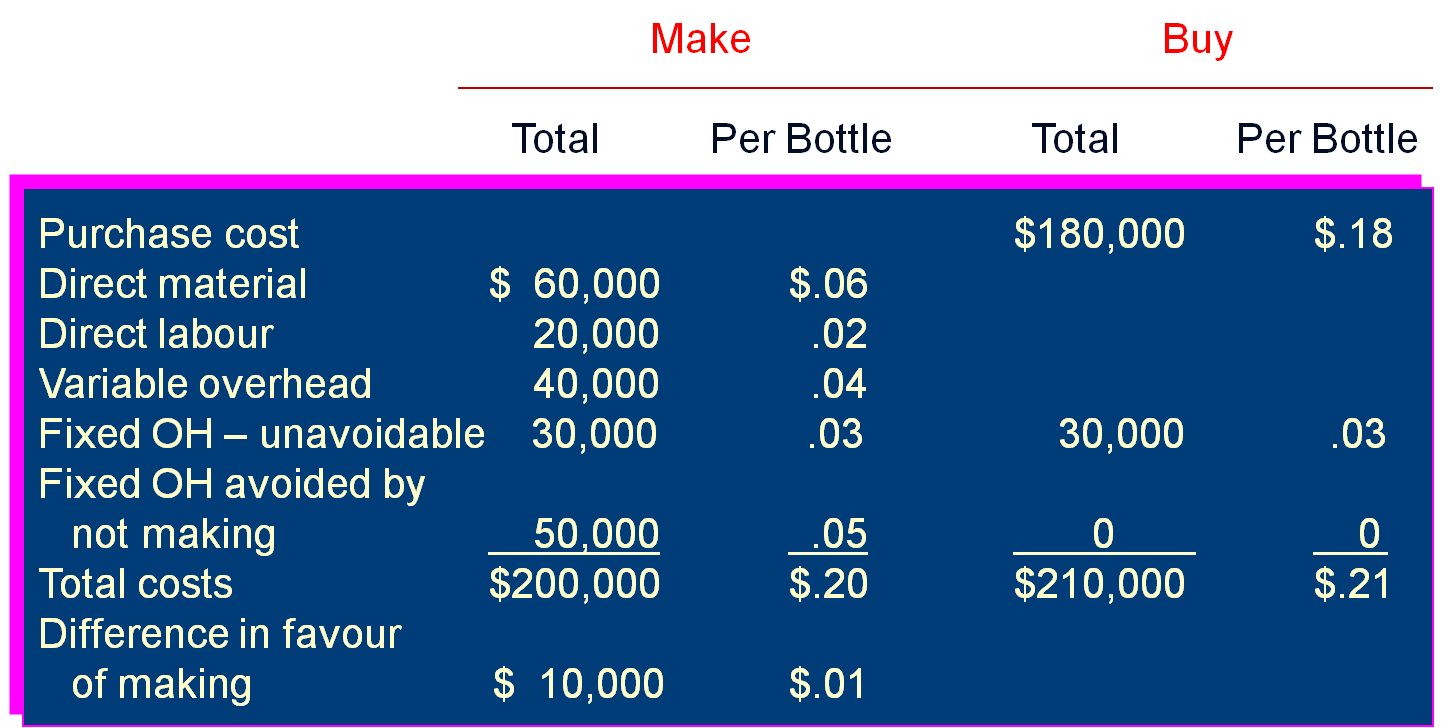

Let’s say also that if Fizzy Wonder accepts the offer of the supplier, $50,000 of fixed overhead would not need to be incurred. Currently, the total fixed overhead incurred when manufacturing 1 million bottles is $80,000. If Fizzy Wonder chooses to outsource the bottles to the supplier, the fixed overhead will reduce to $30,000, hence saving $50,000. This makes sense, because frequently, some costs will continue to be incurred regardless of the choice selected. For example, machinery that has been purchased in the past may need consistent maintenance even when not in operation. The rental of a plant or factory will still need to be paid even if the plant is not actively used.

Let’s draw up some figures to compare the costs of making the bottles versus buying:

You can see that it is still cheaper to make the bottles compared to buying them from a supplier.

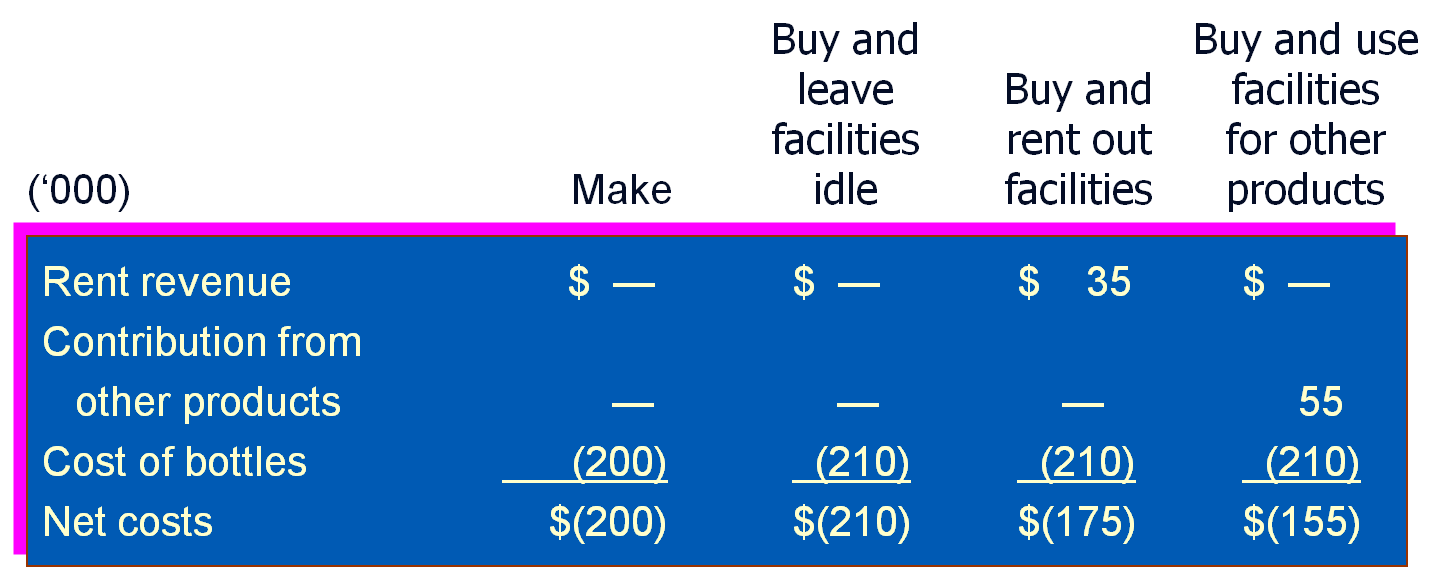

Let’s go further. Suppose Fizzy Wonder can use the released facilities to engage in other manufacturing activities to produce a contribution to profits of $55,000, or can rent them out for $35,000. A summary of the alternatives:

You can see that the net costs for buying the bottles and at the same time, using the idle facilities to make other products, is the cheapest option.

Make or buy decisions: Another example

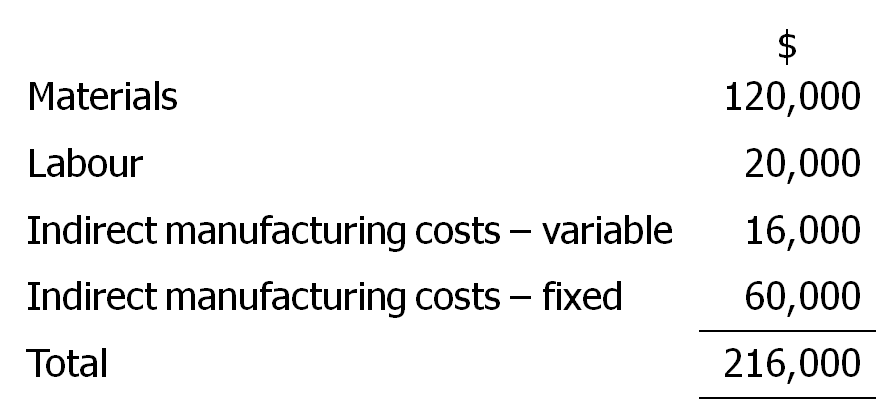

Aloha Fruit Company sells premium-quality oranges by mail order. Protecting the fruit during shipping is important, so the company has designed and produces special shipping boxes. The annual cost to make 80,000 boxes is:

Cost per box = RM2.70.

Suppose an external supplier submits a bid to supply Aloha with boxes for RM2.40 per box. Aloha must give the supplier the box design specifications, and the boxes will be made according to those specs.

How much, if any, would Aloha save by buying the boxes from the external supplier?

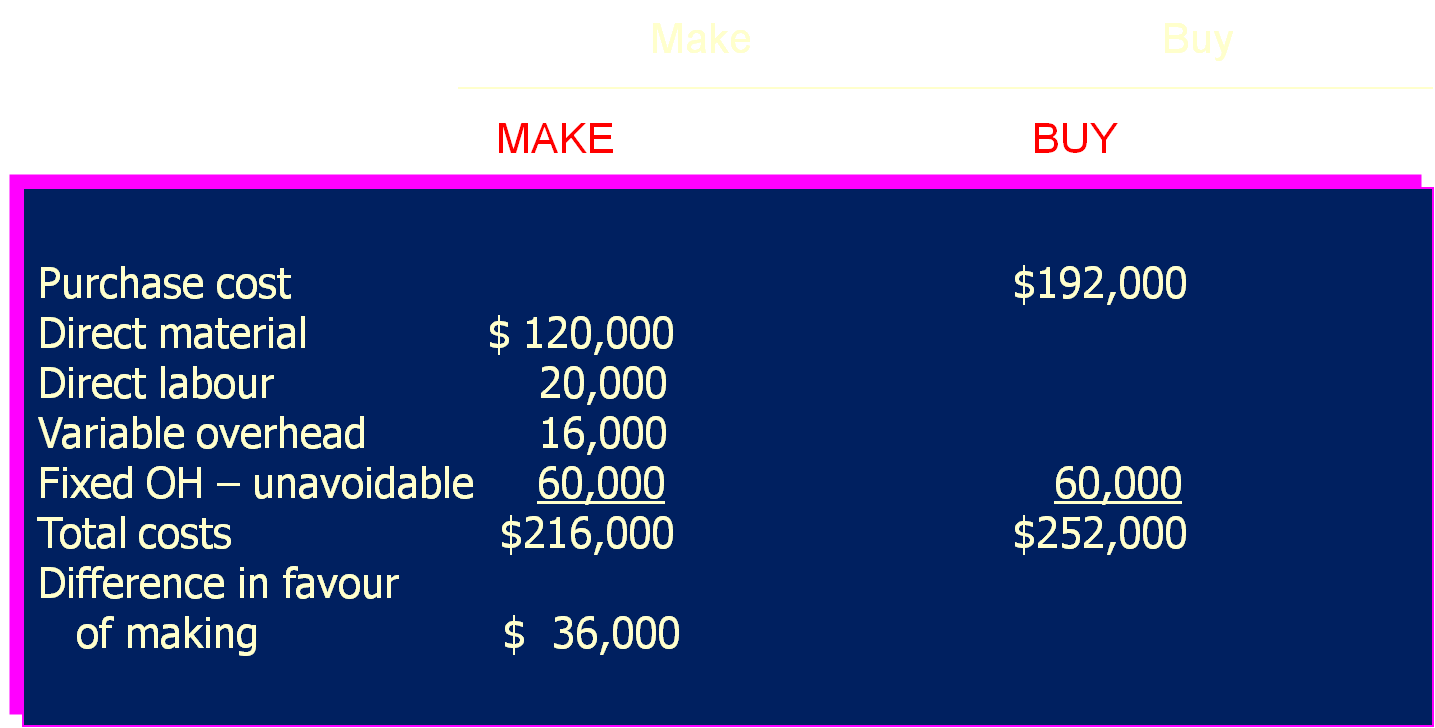

Assume that all RM60,000 of fixed costs will continue if production of the boxes is discontinued.

It is cheaper to make the boxes compared to buying from a supplier.

Suppose all the fixed overhead, i.e. $60,000 represent depreciation on equipment that was purchased for RM600,000 and is just about at the end of its 10-year life. (Hence, annual depreciation is $60,000.) New replacement equipment will cost RM1 million and is also expected to last 10 years.

In this case, how much, if any, would Aloha save by buying the boxes from the supplier?

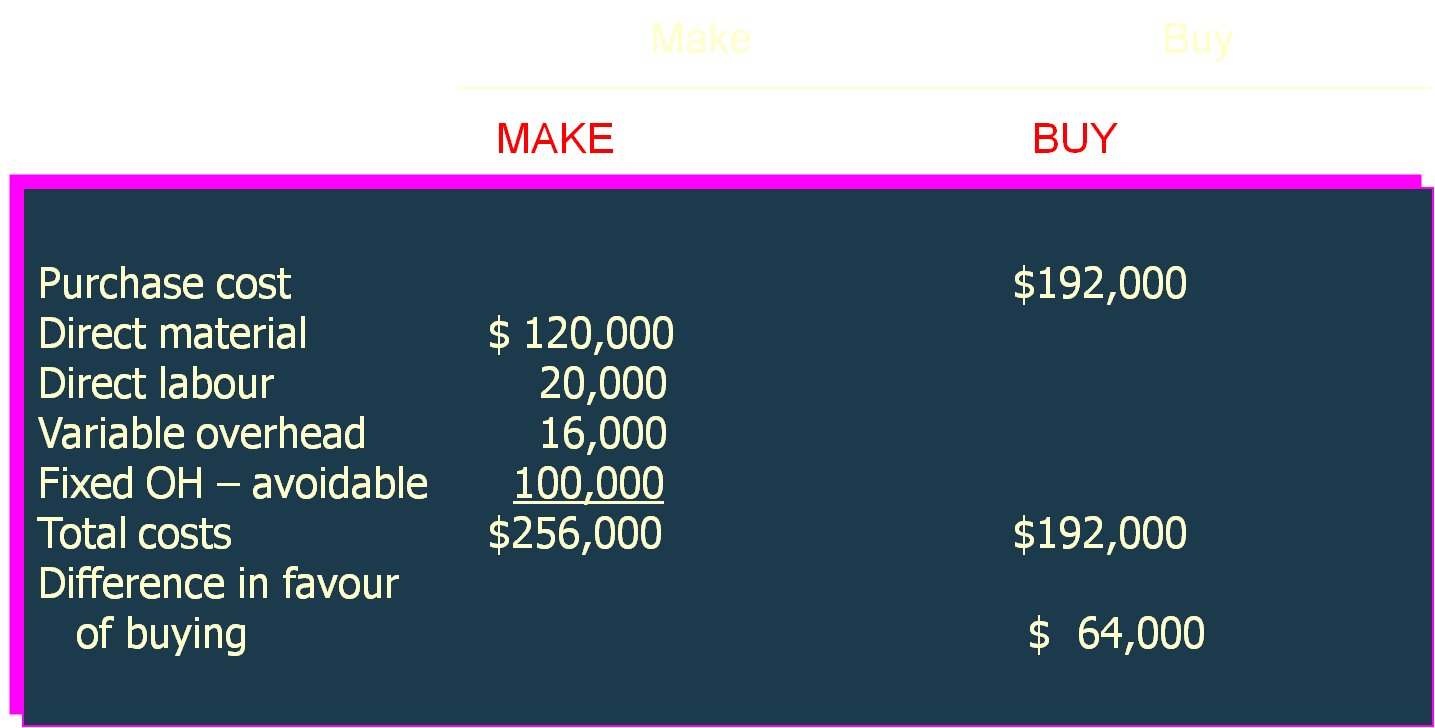

In this case the fixed overhead costs are relevant, because the equipment is about to fail, and a new one has to be purchased, if the company wants to continue making the boxes. Therefore we need to consider the cost of the new equipment, annualised over 10 years, i.e. $100,000 per year.

The cost comparison is as follows:

We can see that now, it is cheaper to buy the boxes from the supplier.

Make or buy decisions:

Qualitative factors to consider

So far, we have been making comparisons in our make or buy decisions based purely on quantitative factors, i.e. costs. But real life is much more than just numbers. Very often, there are qualitative factors to consider. In Aloha’s case, the questions that need to be looked at are:

· Would the supplier raise prices if Aloha closed down its box-making facility? At the moment the prices are fixed at $2.40 per box. But this may not be forever, factoring in inflation and other price increases.

· Will sub-contracting the box production affect the quality of the boxes? Aloha can control the box quality when making it themselves, but not so much when buying from a supplier.

· Is a timely supply of boxes assured, even if the number needed changes? The current deal is for 80,000 boxes. What if demand for Aloha’s oranges increase in the future – can the supplier cope with the increased demand in boxes?

· Does Aloha sacrifice proprietary information when disclosing the box specifications to the supplier? This is in the event that the box design is a unique one and can be patented. For a supplier to make a box with the exact design, Aloha may need to disclose such information. The supplier can then exploit this information by manufacturing the same boxes for Aloha’s competitors.

Return to Introduction to Management Accounting from Make or buy decisions.

Just for fun, here's a make-or-buy comparison on making cheesecake: http://www.thekitchn.com/make-or-buy-cheesecake-155065

Just goes to show that management accounting skills CAN be applied in real life as well!